The Gold Standard:

FERRARI AND

PICASSO

FERRARI AND

PICASSO

We are facing an unprecedented confluence of international macroeconomic conditions that have collided with the unintended result of pushing prices for rare and desirable collectibles far into the stratosphere. Never before have these forces raged with such ferocity and velocity, bringing into alignment the disparate markets of art, classic cars, wine and property. Crystallizing the general malaise, there is the fear of inflation, uncertainty in valuing currencies, wildly gyrating stock markets (trending lower still), banks teetering, interest rates hovering near zero, sovereign debt bordering on worthless, commodity prices under pressure and dramatic political uncertainly and turmoil. It’s depressing just listing the plethora of negativity preoccupying world markets. So what better time to buy a pretty picture,

a good bottle of wine, a nice set of wheels and a big garage to park it in?

Seriously, tangible assets have never before in history been so universally viewed as attractive and safe a harbor to park cash in. Coupled with an offsetting explosion in the generation of wealth in emerging markets over the recent past and you have all the ingredients in place to redefine the criteria for the valuation of collectibles. The beneficiaries are a $250,000,000 Cezanne painting and a $16,400,000 Ferrari.

Sadly, with values rising so meteorically there is something tragic about the notion of paintings we don’t hang, wine we don’t drink, houses we don’t occupy and cars we never drive. Other than an art collection of masterpieces, there is nothing to compare to the lineup of the RAC TT Race at the Goodwood Revival with Cobras and GTOs galore. Julian Treger, principal of Audley Capital, a fund the Financial Times called one of the world’s best last year, stated about art and cars: “They are both hard assets in a world of shortages of the best. Though art and cars have different collectors they have the same dynamics. Ferraris are very sculptural, but also incredibly well branded.” Where and when it will all end is anyone’s guess, but neither a $100 million car nor a $1 billion work of art would surprise me. It may appear somehow wrong and that one should feel a sense of guilt enjoying the pleasures, delights and accompanying rising values of collectibles in the face of such seemingly universal hardship, but business has no moral compass.

Art and cars have become indisputable asset classes and Ferrari and Picasso are the gold standard against which all else is measured.

And although many remain skeptical, I am firmly of the belief that art and cars have inherent, calculable values. The factors driving escalating prices among art and cars coincide: rarity, history, provenance, and condition. The Supreme Court of the United States were asked to decide a case involving pornography and the Chief Justice replied he couldn’t explain it but he knew it when he saw it and the same applies with a great work of art or a sublime piece of automotive design and engineering. Only just recently, seven of auction house Gooding’s top 15 Pebble Beach sellers were Ferraris: why does Ferrari above all other marques tend to dominate? Is it down to aesthetics, or provenance? Art and cars have become indisputable asset classes and Ferrari and Picasso are the gold standard against which all else is measured. However, markets are very unforgiving ecosystems so you had better know your stuff cold or stand a good chance of being run over, and separated from your money in the process. A Warhol from the same year and the same size can sell for $60,000 or $60,000,000 and a Ferrari is no different. There are better and worse Hirsts and Astons. Sadie Coles, one of the most significant and influential international gallery owners states that cars are somewhat easier to define value: “The valuation of a contemporary art work can be mysterious, subjective and unquantifiable. Rare cars are functional objects and however beautiful or rare they may be, they also have easier to define provenances – how many were made, during what dates, who owned them and how many miles they have.” I don’t entirely agree with the above reasoning and think there is as much disingenuousness and indeterminism in unraveling the mysterious, subjective and unquantifiable in cars as in art. Art is admittedly the last unregulated, multi-billion dollar business.

Though the high prices for art and cars can be hard for people to swallow, they are here to stay in at least the near term and with good reason. With art, its who’s buying, selling, writing about and exhibiting the work—these are all contributing factors playing into the notion of determining value. And it’s not all that different with cars; though, rather than which museum the car was exhibited in (this adds value too) its more a matter of which historic races the car was driven in and by whom. Whether cars are equal to art, and vice versa, depends on which is fuller, your walls or garage—it is more a condition of taste and opinion. Hardcore car lovers will say you can’t drive a painting, but art throws off a visual dividend and ease of coexisting beyond what cars can offer. True, you can’t jump in your Van Gogh and race a Monet or head off to the country, but by the same token you can’t climb into bed and drool over your Testarossa. Cars are the most ubiquitous form of industrial design and we see thousands per day, but we don’t see them when we are behind the wheel or when we park them up for the night. That really is unfortunate, as I have my cars in my office and under my desk, and if I could, I would have one under the duvet too.

There appear more and more crossovers between the bedfellows of cars and art, including the phenomenal Renzo Piano designed museum atop the Lingotto building and examples like BMW art cars and the recent sponsorship deal between Volkswagen and the Museum of Modern Art in New York. Art and cars also share some not too positive attributes like the problem of liquidity: try and call your broker in the middle of the night to swiftly dispose of your car and/or art collections! Though art and cars are proven stores of value, nothing goes up forever, despite our strongest wishes. And there are those who climb into either category of collecting to ascend a social ladder, like nailing bags of money to the walls or stuffing notes into the garage and parading around like a peacock with fully exposed feathers.

With art and cars strictly as investment, divorced of aesthetics and functionality it all seems rather perverse. There have cropped up a number of classic car and art funds that look at both as nothing other than asset classes with untapped upside, stripped of use and enjoyment, but they are missing the point—art and cars are so great as investments because of the usability and joy, not just the reductive quality solely as appreciating assets. Shares, bonds and gold go into safes or drawers and draw no satisfaction other than the potential to increase in value. There is more to life— studies exist that say living with art (then why not cars?) can increase your life expectancy like having a loyal golden retriever. I can fully understand and appreciate the notion! Personally, I don’t differentiate between a fork, chair, car or painting. Anything done exceptionally well shares qualities with art, and in the end its simply a matter of nomenclature, of naming and categorizing things that serve no purpose other than creating false hierarchies.

Richard Bremner, one of the UK’s foremost car writers weighs in on the art vs. car debate as follows: “For some, a car can be a thing of beauty, exquisite beauty even, and even the lowliest motor is the result of a creative process that has involved some artistry, no matter how modest. The vast majority of post-war cars, and some pre-wars too, were designed using not only the artistic skills of sketching and rendering designers but those of sculptors too. The result is an object that’s quite capable of pleasing the eye that carries its own story, reflects the era in which it was conceived and the culture of the manufacturer that built it. As with art collecting, classic car acquisition can be about money of course, besides the displaying, coveting and hoarding of these things.”

An exceptional car is nothing to turn your nose up at, but there are many that would do the same with a work of contemporary art. Unfortunately regarding contemporary cars, over regulation and mass production sometimes aid in homogenizing design, which only adds to the values of classics. And in contemporary art, oversupply to feed demand can also lessen the values. There is nothing that can replace passion and connoisseurship in either endeavor including all the endless analysis a private bank could muster. Where will it end? Will it implode, like it did in the late 1980s, or are certain top vehicles now immune to the vicissitudes of the market? Though nothing is endless, art and high-end collector cars are not over leveraged like what might have been the case in decades past. For the most part, we are faced today with end users who have the wherewithal to stay in the game and not have to go prematurely running off the track.

Adam Lindemann, a highly noted collector and writer on art and design, who famously flipped a Jeff Koons sculpture for many millions in profit before it was packed off for shipping, told me that: “Cars are not at all like art, they are like ‘Design’. Buying a great car is like buying a great piece of Art Deco furniture. What matters is provenance and originality. There is no such thing as rolling art, there is however

rolling design. The fact that we live in an age of computer chips, and technology molded into carbon fiber, means that the hand made machines of the last century will be valued objects of the future without a doubt. Over time the great cars can only go up in value, the question is deciding and sourcing the ‘great’ ones from all the other ones.” I find as plausible the thoughts of Kai Schachter (my 14 year old son and no car fanatic like his father) who said, “A car is a piece of art and even though you drive it around, it’s as fragile and delicate and needs to be cared for as much as any painting or sculpture.”

The downside in the public consciousness is that there is a bifurcation in the economy, a wider and wider chasm separating those that have from those that don’t and many are dialing down their standards and style of living. The baby boomers are coming to the end of a party (and a good run It was) and facing the realization that someone is going to have to pay. Countries face the same harsh dilemma: debts are swallowing us all and it can’t go on and on and… It wouldn’t be the best of looks to roll into an Occupy Wall Street protest in your Ferrari with a Picasso in your tent. But let’s face it: since art came off the walls of a cave, it has been coveted and the same goes for life after the combustion engine—once it was invented and inserted into the bay of a car, we’ve had to have them. There is unparalleled seduction in a great car and artwork; the smells (even paint smells enticing), the feel, textures, and sight—a feast for all the senses. Unfathomably in a world wreaked by social, economic and political instability, it has been a record year for auction houses in cars and art, part of the ever-increasing acceptance of the rarity, preciousness and transcendent qualities of both: more so than anyone might have imagined in such recessionary times. We are only but custodians of things, charged with maintenance, preservation and appreciation of unrepeatable, glorious objects. And as we get progressively priced out of markets in cars, art, wine and property, the definition of what is desirable and covetable will only expand.

What a Scream

Imagine if there were 390 Ferrari 250 GTO’s rather than the 39 examples produced. Would those curves and arched hips still appear as sexy, voluptuous and desirable? Or more to the point, would it necessitate an expenditure of $40 million or more to acquire one today if there were so many in existence? In all probability, the answer to the above question would be a firm and resounding no. Sure the car would be the same existentially speaking, but the issue of rarity and desirability would obviously be profoundly be affected. Somehow, the very same car would be perceived as an entirely different entity. Maybe sad and wrong but nonetheless, true.

Human nature craves the rare and unique but not to the extent that we inhabit an island unto ourselves. There is reassurance in the shared familiarity of life and our jointly held experiences, whether this relates to personal relationships or expensive doodads, which sometimes amount to nothing more than incidental decorations. We all want to be perceived as individualistic with our own point of view, just not too separate and removed from our peers.

Maybe this phenomenon reflects a failing of our collective consciousness that we covet status, things we know not everyone is in a position to afford to own, but that others can easily recognize and attribute appropriate value to, and associated prestige to the owner. Beyond cars and luxury consumer items such as handbags, this notion is most conspicuous in the world of fine art. And contrary to popular belief, such a trend developed well before Andy Warhol set up an art factory for the mass production of allegedly original paintings and sculptures.

The concept of limited, special editions as a marketing incentive originally arose in the nineteenth century with published products relating to the arts such as books and prints; yet, the idea of creating art works in a series existed well before with the bronze casting methods employed by ancient Greek, Chinese and Indian civilizations. And, with the likes of Damien Hirst, et al, to paraphrase the famous Virginia Slims cigarette advertising campaign from the late 1960’s, we’ve come a long way, baby.

Today, we have reached dizzying heights of values for what has evolved into mass produced merchandise in the name of original (only in name) fine art. There is such a state of confusion in the marketplace; the very definition of what is one-of-a-kind has been blurred beyond comprehension, so much so that the true meaning of what is limited is in danger of being debased if not obliterated altogether.

In the past, there was the romantic impression of the solitary genius, the artist, toiling away in his or her garret, wrestling with the slow burning impulses of creativity towards a perfect manifestation of self-expression. Not to mention, this flies in the face of the truer state of affairs in the Renaissance, with assistant filled studios and the likes of Rembrandt so financially consumed he bid up his own prints at auction. But today, we have the artist as commercial brand manager and budding (junior) celebrity, hanging at clubs with Tom Cruise and P. Diddy, beyond the outermost reaches of comprehension.

Artist brands have become so prevalent and powerful that the products they produce can defy all logic of value, and the proposed creator has become so removed from the items they “create”, we merely buy to keep up with the lifestyle of our neighbors, largely driving the art market; she has one, so naturally, I want one. In this high stakes world of art we now inhabit, when does an edition become an original and an original an edition? One explanation as to why there is such a recent spike in prices for multiple iterations of supposedly novel works is because they haven’t stood the test of time and thus rely on huge exposure to obtain familiarity, acceptance and, ultimately, value.

Pablo Picasso, who was said to have created approximately 50,000 works, dipped into just about every possible media an artist could create, from paintings, sculptures, drawings, prints, multiples, ceramics and more, and was a progenitor of the artist as branding machine. He was also obsessed with money and the market for his works, and when asked what a painting was about, is said to have responded: about fifty grand to you. The record for a limited edition print is $5,122,500 and happens to be held by the big boss himself; executed in 1937, the work was number three from an edition of fifteen with seven proofs. Warhol, the mastermind of imagination manufacturers, said to have been responsible for more than 100,000 works, took the model of multiple impression prints

and applied them to paintings and sculptures. Though an artist working in a series was nothing new in the history of art, Warhol stretched it far and wide beyond previous conceptions, and then some. The result was a catalogue raisonné of paintings and sculptures that took 20 years to compile only the first volume, encompassing the years 1961–1963. And even this is not considered to be the definitive and final word on that period. The problem is that authentication has become such a volatile and contested subject that the committee empowered with determining what is and is not genuine has disbanded in the face of mounting legal costs due to monitoring such cloudy and unclear terrain. In the world of the high-end special edition, more than ever the warning buyer beware applies; and, with the Warhol record said to be upwards of $150 million or more, you had better take it to heart.

The German painter Gerhard Richter has painted a series of thousands of colorful abstract paintings by dragging a squeegee across the paint soaked surface of a canvas, not unlike having your car windshield cleaned against your wishes at a traffic light. Only the record for one of these concoctions, formerly owned by Eric Clapton, is $34 million. The innovative way Richter has avoided the murky waters of verification of his many works is that he had numbered every piece he ever made since the early 1960’s. Then there was the unprecedented move to establish his website: GerhardRichter.com, where you can search each and every work in the artist’s oeuvre by inventory number. Sometimes, the systematic and highly regimented ways of the Germans have positive implications.

Then there is Jeff Koons, who takes a very hands-off approach to knocking out his cartoon paintings and sculptures of pool toys, and just notched an auction record of over $33 million, only just below that of Richter (the highest ever achieved for a living artist). The work, Tulips, which necessitated a fabrication period of more than nine years, was said to be unique only in as much as each of the series is in different colors. Kitsch doesn’t come cheaply; I remember the quaint old times when sculptors sculpted vs. the day of the had-it-made.

With Hirst, the master of shock-schlock, there are so many goods churned out of the studio, how could you even distinguish between the genuine articles from the surfeit of counterfeits? The real works he “makes” are as fake as the fake works are real. This is marketing madness writ large. When will we come to our senses and make it stop? Despite his prices being down 30% from the top of his market when he shifted 218 works to the tune of $200 million from the first-ever single artist sale at auction, entitled “Beautiful Inside My Head Forever,” every new collector still seems to need one of the same. The question remains, why?

Banksy is the highflying, anonymous bad boy of street art but can you bank on his representations as to the extent of his editions? For years, the editor of the Times has been calling me to confirm rampant speculation that he frequently exceeds the numbers of his stated print runs. This harks back to the reasons why it took the contemporary art market so long to warm up to photography, which was partly due to the suspicion and ease of edition overruns. But the art market has a thick skin: the highest price ever paid for a photograph was $4.3 million last year for Andreas Gursky’s “Rhein II”, from an edition of 6, not to mention a few artist’s proofs. That’s a snappy number for a snapshot.

Urs Fischer is a 39-year-old Swiss artist whose giant bronze teddy bear sculpture sold for $6.8 million last year at auction, in an edition of 2 plus an artist’s proof. Nowadays, a proof has nothing to do with the process of trial and error to make the best possible work as it was in the past, but rather a sneaky moniker to eke out some extra copies on the sly, while still keeping edition numbers low for appearances—the lower the run, the rarer and more sought after the object. A few years ago I bought a work and after the fact was informed that the artist unilaterally decided to increase the edition from 2 to 3, thereby diluting my purchase by fully one third. How irritating was that? Perhaps the purchase price should have been reduced proportionately; don’t think I didn’t try.

Then there is the dissident Chinese artist Ai Weiwei, who is as much of a political protagonist as a market antagonist. As Warhol ingratiated himself with celebrities to buttress his art world standing and price points, so Ai tangles with the authorities with the concomitant consequence that his exposure exponentially increases as do his auction results. I am not so cynical as to state his protests are contrived, but every month he’s in jail his market goes up 10%. And here is the clincher; he never calls his repetitive editions of works “editions”, under the guise that each piece is ever so slightly different from the next even if they are ostensibly the identical. This is a new occurrence in the art market where each swirl and vein in a piece of marble is all it takes to constitute originality. In fact Ai’s dealers are even unsure of how many of each new version of a given work is outstanding. For someone who campaigns against corruption, that’s some racket.

These shenanigans are not exclusive to the world of fine art; you can also find such schemes and strategies prevalent in the fields of design and jewelry. Faberge Eggs made for Russian Emperors and the like, were recognizable as variations on a theme, unique but part of a series, all the better to add cachet used to market to wider audiences. That’s what you can refer to as hatching a plan for financial success. Ettore Sottsass introduced his bright red plastic Valentine typewriter in 1969, which became a ubiquitous must have object of desire, thus contributing to the branding of his serious architecture, design and art by turning a utilitarian object, the lowly typewriter, into a must have fashion accessory.

The current expression of such tactics is the field of Design Art—a term that was coined by an auction house to market furniture as limited edition sculpture, and raise the prices accordingly in the process. Marc Newson, the poster boy for Design Art who’s “Lockheed Lounge” chair, in an edition of 10 plus 4 proofs (see above described logic), sells for $2 million a pop. Better watch your crumbs when you are lounging.

Ultimately, if an image is only available in a run of, say, 10, is it automatically a more valuable commodity much more likely to be purchased than if 250 are available? It shouldn’t really matter, should it? If you like something, you like it, don’t you? After all, it didn’t seem to bother American financier Leon Black who purchased one of four extant versions of Edvard Munch’s “The Scream” for $120 million at auction this year.

Kenny Schachter

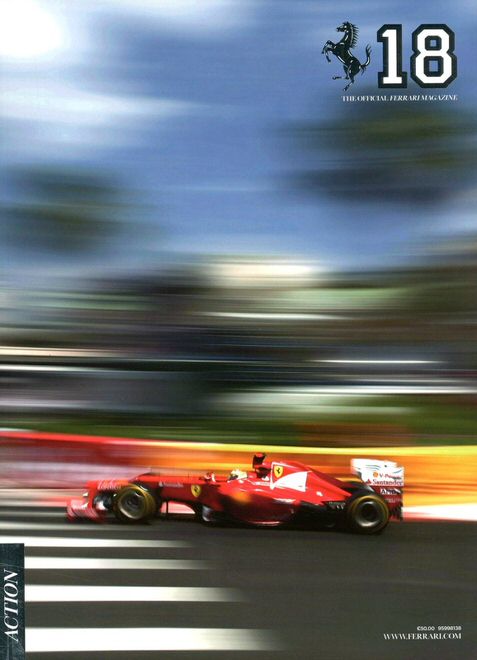

* This article was originally published in The Official Ferrari Magazine, Issue #18, Fall 2012.